Our Fund

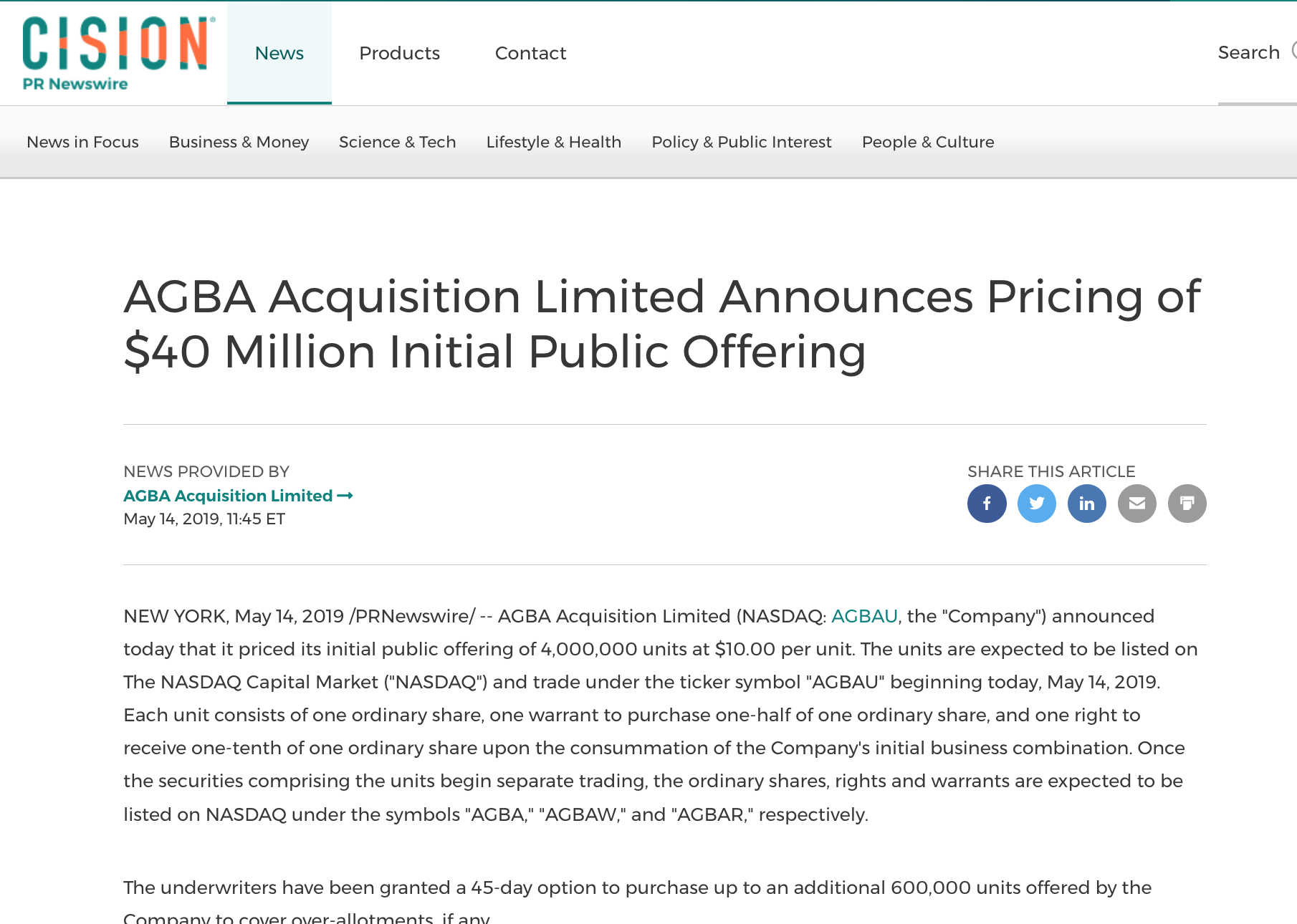

On May 6, 2019, the first day of the road show, U.S. President Trump announced that he would impose a 25% tariff on $200 billion worth of Chinese goods. On May 9th, the negotiations failed, the trade war was about to start, the market atmosphere was negative and the team was under great pressure. Even in such situation, our team members, relying on rich experience, still attracted many investors. Philip Goldstein, a famous American investor, spoke highly of performance of AGBA team, claiming that it was one of the best roadshows he had experienced. Although the China-US trade war triggered a negative market atmosphere, the company‘s management team still received wide recognition from investors, which fully demonstrates that capital knows no borders and that U.S. investors are always bullish on China’s future.

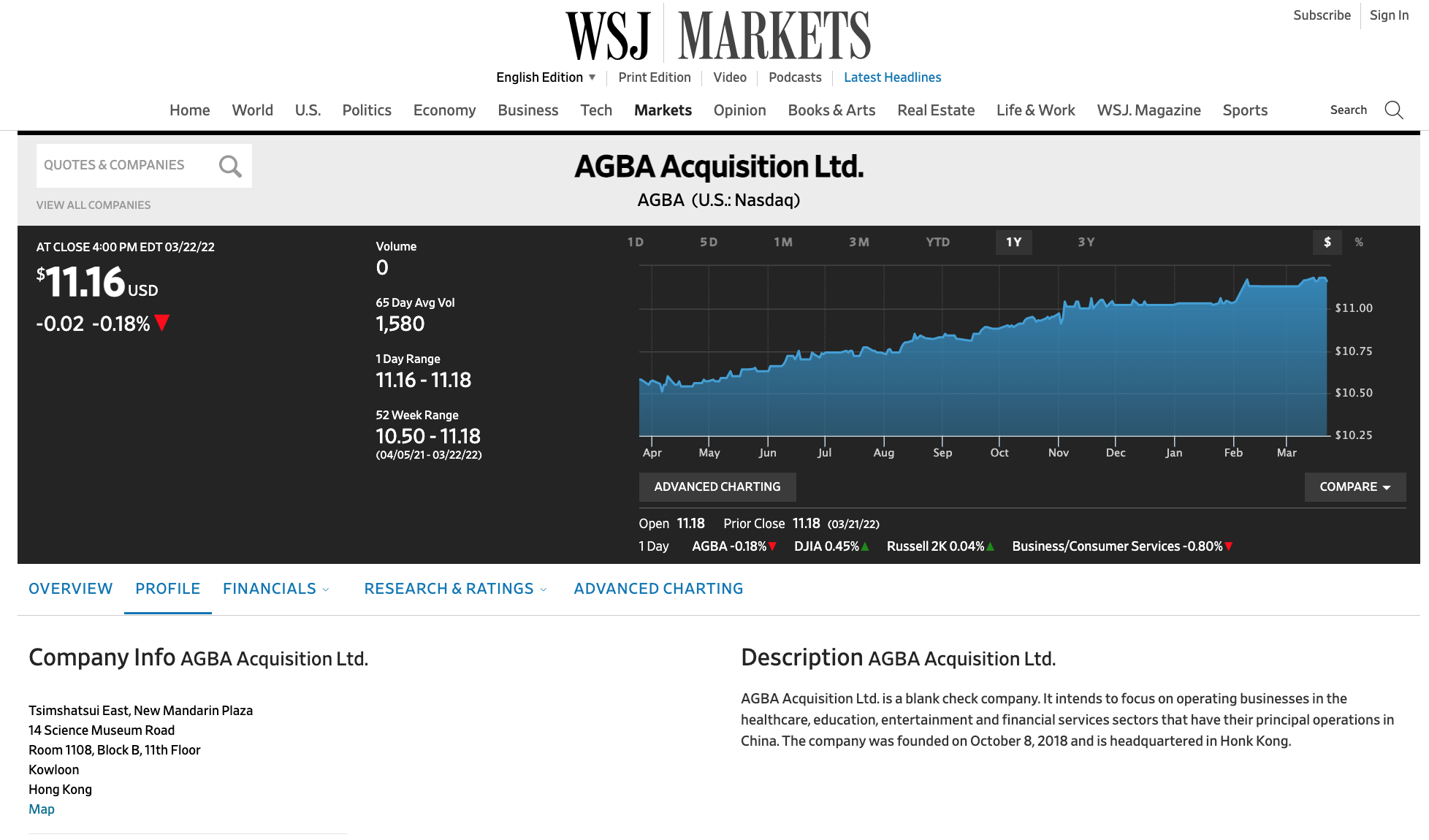

At 10: 00 a.m. on May 14th, 2019, AGBA Acquisition Limited raised $46 million and got listed on NASDAQ with the stock symbol AGBA.

On November 4th, 2021, AGBA Acquisition Limited(“AGBA “) announced a merger agreement with Tag Holdings Limited (“TAG “), a subsidiary of Convoy Global. This transaction makes TAG’s valuation of nearly $555 million, and the combined company’s valuation is about $600 million if no shareholders exercise the right of redemption. At the time of deal closing, it is expected that TAG will simultaneously obtain PIPE of not less than $35 million.

AGBA Acquisition Limited Announces Business Combination Agreement with TAG Companies

“A successful SPAC needs to be thoughtful about all phases of the SPAC life-cycle, from target search, diligence, post combination value-add through to public market stakeholder management. Our mission at AGBA is to partner with fundamentally attractive enterprises as they journey into the U.S. public markets and create sustainable value for shareholders. We are extremely honored to become associated with OnePlatform Holdings Limited and TAG Asia Capital Holdings Limited, companies with an accomplished management team, as they develop innovative financial products and services to address customers’ evolving needs. We look forward to working together to complete the business combination,” said Gordon Lee, CEO of AGBA.

AGBA Acquisition Limited Files for SPAC IPO

AGBA will be led by Gordon Lee, as Chief Executive Officer, and Vera Tan, as Chief Financial Officer. Looking at Mr. Lee’s bio in the prospectus, he is for sure an entrepreneur having founded a diverse number of businesses spanning education, gaming and even a music streaming application. Vera Tan, brings the requisite finance skills having worked in a variety of positions at Deutsche Bank, Mizuho and Goldman Sachs.